Introduction

Budgeting is the cornerstone of financial success, whether you’re just starting or looking to improve your current financial situation. It may seem overwhelming, especially if you’re just starting out. However, with the right approach, it doesn’t have to be complicated. This guide will walk you through simple budgeting tips for beginners that can help you take control of your finances with ease.

Amazon Affiliate Disclosure:

This post contains Amazon affiliate links. If you make a purchase through these links, I may earn a small commission at no additional cost to you.

Disclaimer:

I am not a financial advisor. The information provided in this article is for educational purposes only. Please consult with a financial professional before making any financial decisions.

I. Understanding Your Income and Expenses

Managing your personal finances starts with understanding your income and expenses. It’s the foundation of any good financial plan. If you don’t know where your money is coming from or where it’s going, it’s hard to make informed decisions about your spending, saving, and investing. Let’s dive into how you can get a clear picture of your financial situation and start making smarter money choices today.

Tracking Your Income: Know What’s Coming In

The first step to understanding your finances is knowing how much money you actually bring in each month. This might seem straightforward, but you might be surprised at how many people don’t have a clear idea of their total income. Your income includes your salary, any freelance work, side gigs, rental income, and any other sources of money. It’s important to account for everything, no matter how small.

Start by listing all your income sources and noting down how much you earn from each. If your income varies each month, like if you’re a freelancer, take an average of the last six months to get a better picture. This way, you won’t be caught off guard during a low-income month. Don’t forget to include irregular income like bonuses or tax refunds.

You can use a simple spreadsheet or one of the many personal finance apps available to track your income. The key is to be consistent. Check your accounts regularly and update your records so you always know exactly where you stand. This knowledge will give you a solid foundation to build your budget and make informed financial decisions.

Identifying Your Expenses: Where Does Your Money Go?

Now that you’ve got a handle on your income, it’s time to look at your expenses. Understanding where your money goes each month is crucial for effective money management. Start by categorizing your expenses into fixed and variable costs. Fixed expenses are those that stay the same each month, like rent, mortgage payments, and insurance premiums. Variable expenses, on the other hand, can fluctuate from month to month, like groceries, entertainment, and utility bills.

Begin by listing all your fixed expenses. These are usually the easiest to track since they don’t change often. Next, move on to your variable expenses. This is where things can get a bit tricky, but don’t worry. A good way to track these is by keeping all your receipts or using a finance app that automatically categorizes your spending. You can also review your bank and credit card statements to get an accurate picture of your spending habits.

Be honest with yourself during this process. It can be eye-opening to see how much you’re spending on certain things. Maybe those daily coffee runs or frequent dining out expenses are adding up more than you realized. Knowing where your money goes will help you identify areas where you can cut back if needed. The goal isn’t to make you feel bad about your spending but to give you the information you need to make better choices.

Budgeting tips for beginners often emphasize the importance of knowing where your money is going, so make this a priority.

Balancing Your Budget

Once you’ve tracked your income and expenses, it’s time to compare the two. This is where the magic happens. Ideally, your income should be higher than your expenses. If it is, congratulations! You can use that extra money to save, invest, or pay off debt. If your expenses are higher than your income, don’t panic. This is a common issue, but it’s fixable with a bit of planning and discipline.

Start by calculating your total monthly income and subtracting your total monthly expenses. If you have money left over, think about how you can allocate it wisely. Could you boost your emergency fund, invest for the future, or pay down debt? On the other hand, if you find yourself in the red, it’s time to take a closer look at your variable expenses. These are usually easier to adjust than fixed expenses.

Consider setting a budget for categories like entertainment, dining out, and shopping. This doesn’t mean you have to cut out all the fun from your life, but it can help you prioritize your spending and make sure you’re not overspending in any one area. You might also find creative ways to save, like cooking at home more often or finding free or low-cost entertainment options.

Staying on Track

Keeping a close eye on your income and expenses can seem daunting at first, but it gets easier with practice. Here are some tips to help you stay on track:

- Set Financial Goals: Having clear goals can motivate you to stick to your budget. Whether you’re saving for a vacation, a new car, or retirement, knowing what you’re working towards can help keep you focused.

- Review Regularly: Make it a habit to review your income and expenses at least once a month. This will help you catch any discrepancies early and adjust your budget as needed.

- Use Technology: There are plenty of apps that can help you track your finances effortlessly. Find one that works for you and use it consistently.

- Be Flexible: Life happens, and sometimes expenses come up that you didn’t plan for. Don’t beat yourself up if you go over budget. Instead, adjust your plan and keep moving forward.

- Seek Help If Needed: If you’re struggling to manage your finances, don’t hesitate to seek help. There are financial advisors and counselors who can provide guidance and support.

Tip: you might consider using a Clever Fox Budget Book or an Expense Tracker Notebook to manually record and monitor where your money is going each month.

II. Setting Realistic Financial Goals

Setting financial goals can be exciting, but it’s important to keep them realistic. When your goals are achievable, you’re more likely to stay motivated and reach them. Let’s explore how to set realistic financial goals that will help you build a solid financial future.

Tip: One of the best budgeting tips for beginners is to break down your goals into manageable steps, making it easier to achieve them over time.

Understand Your Financial Situation

Before setting any goals, you need to understand your current financial situation. Take a look at your income, expenses, and any debt you have. Knowing where you stand financially will help you set goals that are attainable and relevant to your situation.

Start by listing all your sources of income and your regular expenses. Don’t forget to include those small, often-overlooked expenses like coffee runs or streaming subscriptions. Knowing exactly how much money is coming in and going out each month gives you a clear picture of what you can realistically achieve.

Define Your Short-Term Goals

Short-term goals are things you want to achieve in the near future, typically within a year. These goals are like stepping stones to your larger financial objectives. They can help you build momentum and confidence as you achieve them.

Think about what you want to accomplish in the next year. Maybe you want to save for a vacation, pay off a small credit card debt, or start an emergency fund. Choose goals that are important to you and will make a positive impact on your financial situation. Be specific about the amount you need and the timeframe in which you want to achieve it.

For example, instead of saying, “I want to save money,” try “I want to save $1,000 for a vacation in six months.” This makes your goal clear and gives you a target to aim for. Break down your goal into smaller, manageable steps, like saving $167 each month.

Plan for Long-Term Goals

Long-term goals are those you want to achieve in five, ten, or even twenty years. These goals might include buying a house, funding your children’s education, or saving for retirement. Long-term goals require more planning and discipline but are crucial for your financial well-being.

When setting long-term goals, think about what you want your future to look like. Consider how much money you’ll need and when you’ll need it. Use tools like retirement calculators or consult a financial advisor to help you estimate the amount required.

Once you have a clear picture, break down your long-term goals into smaller, actionable steps. For example, if you want to save $200,000 for retirement in 20 years, figure out how much you need to save each year, month, or even week to reach that target. Automating your savings can make this process easier and ensure you stay on track.

Be SMART About Your Goals

A great way to ensure your financial goals are realistic is to make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. This approach helps you create clear and attainable goals.

- Specific: Clearly define what you want to achieve. For example, “Save $5,000 for a down payment on a car.”

- Measurable: Make sure you can track your progress. If your goal is to save $5,000, you can measure how much you save each month.

- Achievable: Set goals that are challenging but possible. If you can only save $200 a month, don’t set a goal to save $10,000 in six months.

- Relevant: Choose goals that matter to you and align with your values. If owning a home is important to you, prioritize saving for a down payment.

- Time-bound: Give yourself a deadline. Having a timeframe creates a sense of urgency and helps you stay focused.

Adjust and Reevaluate Your Goals

Life is full of surprises, and your financial situation can change. It’s important to regularly review your goals and adjust them as needed. Maybe you got a raise and can save more, or perhaps an unexpected expense came up, and you need to adjust your timeline.

Set a reminder to review your financial goals every few months. Check your progress and see if you’re on track. If you’re not, don’t get discouraged. Instead, look for ways to adjust your plan. Maybe you need to cut back on discretionary spending or find additional income sources.

Tip : Tools like the Your Best Year Ever by Michael Hyatt can help you set actionable goals. Additionally, The Total Money Makeover by Dave Ramsey is a powerful guide that offers a structured approach to financial planning and goal setting.

III. Creating a Monthly Budget Plan

Creating a monthly budget plan might sound daunting, but it’s easier than you think. Plus, having a budget is a game-changer for your finances. Let’s break it down step-by-step to make the process simple and even a little fun.

Tip: A simple budgeting plan involves allocating specific amounts for your needs, wants, and savings.

List All Your Income Sources

First things first: you need to know how much money you’re working with each month. This means listing all your income sources. Include your salary, freelance gigs, side hustles, and any other money you regularly receive. Knowing your total income gives you a solid starting point for your budget.

Grab a piece of paper or open a spreadsheet and jot down all the ways money comes into your life. Be as detailed as possible. If your income varies, like if you freelance, use an average of the last few months to get a realistic picture. This step sets the foundation for your budget plan.

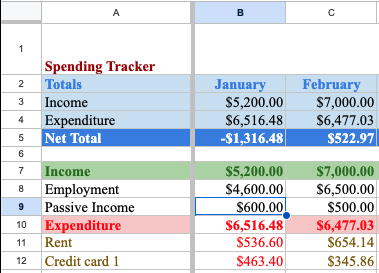

Track Your Expenses

Next, it’s time to get a clear view of where your money goes. Tracking your expenses might seem tedious, but it’s essential for creating an effective budget. Start by listing all your fixed expenses, like rent, utilities, and insurance. These are the bills you pay every month, usually for the same amount.

Then, move on to your variable expenses. These can change month-to-month and include things like groceries, entertainment, and dining out. You can use a budgeting app to help you track these or keep all your receipts and note them down at the end of the day. Seeing all your expenses laid out can be eye-opening and helps you understand your spending habits.

Categorize Your Spending

Once you’ve tracked your expenses, it’s time to categorize them. This step makes it easier to see where your money goes and identify areas where you can cut back if needed. Common categories include housing, transportation, groceries, dining out, entertainment, savings, and debt repayment.

Creating categories helps you organize your budget and ensures you don’t miss any important areas. Be honest with yourself during this process. If you’re spending a lot on takeout or shopping, acknowledge it. The goal is to have a clear picture of your spending so you can make informed decisions.

Set Spending Limits

Now that you’ve categorized your spending, it’s time to set spending limits for each category. These limits should align with your financial goals and income. For example, if you’re trying to save more, you might set a lower limit for entertainment and dining out.

Setting spending limits helps you control your expenses and ensures you’re not overspending in any one area. Be realistic with your limits. If you set them too low, you might get discouraged and give up on your budget. Remember, your budget should be flexible and adaptable to your lifestyle.

Allocate Money for Savings

A crucial part of any budget plan is allocating money for savings. Whether you’re saving for an emergency fund, a vacation, or retirement, make sure to include savings as a category in your budget. Treat your savings like a fixed expense and set aside a specific amount each month.

If possible, automate your savings. This way, the money goes into your savings account without you having to think about it. Starting with a small amount is okay; the important thing is to make saving a regular habit. Over time, your savings will grow, and you’ll be glad you made it a priority.

Monitor and Adjust Your Budget

Creating a budget is not a one-time task; it’s an ongoing process. You need to monitor your spending regularly and adjust your budget as needed. Life happens, and unexpected expenses can pop up, so it’s essential to be flexible.

Review your budget at least once a month. Compare your actual spending to your budgeted amounts and see if you stayed within your limits. If you went over in one category, look for ways to cut back in others. Adjust your spending limits and categories as needed to reflect changes in your income or expenses.

Tip: When it comes to creating a budget, you might find a Texas Instruments BA II Plus Professional Financial Calculator Silver 9.8 Inch helpful for making precise financial calculations.

Tips for Sticking to Your Budget

Sticking to a budget can be challenging, but with the right tips and tricks, you can stay on track. Let’s explore some practical and fun ways to keep your budget in check and make managing your money a breeze.

Set Clear and Achievable Goals

One of the best ways to stick to your budget is by setting clear and achievable goals. When you know exactly what you’re working towards, it’s easier to stay motivated and focused. Your goals can be anything from saving for a vacation to paying off debt or building an emergency fund.

Make your goals specific and time-bound. Instead of saying, “I want to save money,” try, “I want to save $500 in three months.” This gives you a clear target and a sense of urgency. Break down your goals into smaller milestones to make them more manageable and celebrate your progress along the way.

Use Budgeting Tools and Apps

Technology can be a great ally in helping you stick to your budget. There are many budgeting tools and apps available that can simplify the process and keep you accountable. These apps can track your spending, categorize expenses, and even send you alerts when you’re nearing your budget limits.

Find a budgeting tool that suits your style and needs. Some people prefer apps like Mint or YNAB (You Need a Budget), while others might like a simple spreadsheet. The key is to use a tool that you find easy and convenient, so you’ll be more likely to stick with it.

Track Your Spending Daily

Tracking your spending daily helps you stay aware of where your money is going and keeps you in control. It might seem like a hassle at first, but it quickly becomes a habit. Plus, it only takes a few minutes each day.

Keep all your receipts and note down every purchase you make. You can use a notebook, a budgeting app, or even your phone’s notes app. By tracking your spending, you’ll quickly see patterns and areas where you might be overspending. This awareness is crucial for sticking to your budget.

Plan for Fun and Flexibility

A budget doesn’t mean you have to cut out all the fun from your life. In fact, planning for fun expenses can help you stick to your budget better. Allocate a portion of your budget to entertainment, dining out, or hobbies. This way, you can enjoy yourself without feeling guilty.

It’s also important to build flexibility into your budget. Life is unpredictable, and sometimes expenses pop up that you didn’t plan for. Having a buffer or miscellaneous category in your budget can help you handle these surprises without derailing your entire plan.

Use Cash for Discretionary Spending

Using cash for discretionary spending can help you stick to your budget by making your spending more tangible. It’s easy to swipe a card without thinking, but handing over cash feels more real. Once the cash is gone, you know you’ve reached your limit.

At the beginning of each week, withdraw the amount you’ve budgeted for discretionary spending. Use this cash for things like dining out, entertainment, and shopping. When the cash runs out, that’s it for the week. This simple trick can help you control impulse spending and stay within your budget.

Avoid Temptation

One of the biggest challenges in sticking to a budget is avoiding temptation. Whether it’s online shopping, dining out, or spontaneous purchases, temptations are everywhere. The key is to identify your spending triggers and find ways to avoid them.

If you’re tempted by online shopping, unsubscribe from marketing emails and remove saved payment information from your favorite sites. For dining out, plan your meals and keep snacks handy to avoid the urge to grab takeout. Find alternative activities that don’t involve spending money, like hiking, reading, or free community events.

Review and Adjust Your Budget Regularly

A budget isn’t set in stone; it should evolve with your financial situation and goals. Reviewing and adjusting your budget regularly ensures it remains realistic and effective. At least once a month, sit down and go over your budget. Compare your actual spending to your budgeted amounts and see where you did well and where you can improve.

If you find that you consistently overspend in certain categories, adjust your budget to reflect your actual spending habits. This might mean cutting back in other areas or finding ways to increase your income. Regular reviews help you stay on top of your finances and make informed decisions.

Reward Yourself for Sticking to Your Budget

Celebrating your successes, no matter how small, can boost your motivation and make budgeting more enjoyable. When you stick to your budget or reach a financial goal, reward yourself with a small treat. It doesn’t have to be expensive; it could be a movie night, a special dessert, or a new book.

Rewards reinforce positive behavior and make the process of budgeting more fun. Just make sure your rewards don’t blow your budget. The idea is to acknowledge your hard work and keep you motivated to continue.

Conclusion

Budgeting doesn’t have to be difficult. By following these simple budgeting tips for beginners, you can take charge of your finances and work towards a more secure financial future. Start today, and you’ll soon see the benefits of a well-planned budget.

To build on your budgeting knowledge, consider reading The Simple Path to Wealth by JL Collins. This book offers a straightforward approach to building long-term wealth through smart financial decisions.

#Ad – Explore These Popular Items on Amazon

ANRABESS Women Sherpa Fleece Sweatshirt Half Zip Pullover Casual Warm Fuzzy Sweater Coat 2024 Fall Fashion Outerwear

ANRABESS Women Sherpa Fleece Sweatshirt Half Zip Pullover Casual Warm Fuzzy Sweater Coat 2024 Fall Fashion Outerwear Apple AirPods 4 Wireless Earbuds, Bluetooth Headphones, with Active Noise Cancellation, Adaptive Audio, Transparency Mode, Personalized Spatial Audio, USB-C Charging Case with AppleCare+ (2 Years)

Apple AirPods 4 Wireless Earbuds, Bluetooth Headphones, with Active Noise Cancellation, Adaptive Audio, Transparency Mode, Personalized Spatial Audio, USB-C Charging Case with AppleCare+ (2 Years) XIEERDUO Long Puffer Vest Women Outerwear Reversible Fleece 2024 Fall Winter Warm Sleeveless Zip Up Hoodie Coat with Pockets

XIEERDUO Long Puffer Vest Women Outerwear Reversible Fleece 2024 Fall Winter Warm Sleeveless Zip Up Hoodie Coat with Pockets Infantino My 1st Tumbler – Adorable Miniature Tumbler with Toddler-Friendly Straw and Handle, Encourages Hydration, Easy to Clean, 9 fl. oz, Alpine

Infantino My 1st Tumbler – Adorable Miniature Tumbler with Toddler-Friendly Straw and Handle, Encourages Hydration, Easy to Clean, 9 fl. oz, Alpine Gacaky Women’s Lightweight Floral Embroidered Cropped Quilted Jacket Winter Warm Button Down Puffer Jacket Coat with Pockets

Gacaky Women’s Lightweight Floral Embroidered Cropped Quilted Jacket Winter Warm Button Down Puffer Jacket Coat with Pockets

13 thoughts on “Budgeting 101: Master Your Money in 3 Simple Steps”

This is a beautifully written blog chock-full of useful financial advice and wise tidbits. In today’s world, common sense is not so common. Tanshik.com teaches us practical wisdom, offering clear and actionable insights to help us manage our finances with confidence.

Thank you Oumouri.